The US market grows at 6.6% CAGR, driven by specialty plastics, EV, electronics, and clean tech, with focus on high-dispersion grades and EPA compliance.

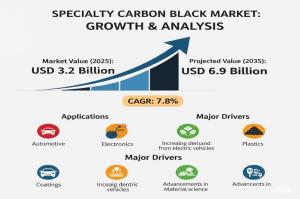

NEWARK, DE, UNITED STATES, August 12, 2025 /EINPresswire.com/ — The global Specialty Carbon Black Market is poised for a decade of accelerated growth, projected to climb from USD 3.2 billion in 2025 to USD 6.9 billion by 2035, advancing at a steady 7.8% CAGR. This expansion reflects rising demand for high-performance materials that address critical challenges in automotive, electronics, energy storage, coatings, and packaging sectors.

For manufacturers, specialty carbon black is no longer just a pigment; it’s a performance enabler, delivering conductivity, UV protection, durability, and tensile strength essential for next-generation products.

Driving Performance Across Industries

The surge in demand is fueled by specialty carbon black’s ability to enhance product quality in rubber, plastics, coatings, and battery electrodes. In automotive and industrial applications, it supports the production of high-strength, abrasion-resistant, and conductive materials, meeting both performance and regulatory standards.

Manufacturers are increasingly prioritizing granular forms, which will account for 53.8% of the market in 2025, due to their ease of handling, reduced dust, and superior dispersion. This form boosts operational efficiency while ensuring consistent quality in rubber compounding and polymer manufacturing.

The conductive carbon black segment leads the grade category with 39.5% market share in 2025, driven by its critical role in tires, cables, electronic components, and EV batteries. Its ability to impart controlled electrical properties makes it indispensable in safety-critical and performance-oriented applications.

Rubber remains the dominant application, holding 47.1% of market revenue in 2025, supported by growing automotive production, industrial expansion, and demand for high-performance tires.

Regional Growth Opportunities

Asia-Pacific remains the growth powerhouse.

• China leads with a 10.5% CAGR, leveraging its leadership in lithium-ion battery production and high-performance polymer manufacturing. Expanding capacity and sustainability-driven innovations in low-emission processes further position China as a key supply hub.

• India follows with 9.8% CAGR, powered by infrastructure growth, polymer compounding, and packaging demand. Increased adoption of conductive grades in power cables and electronics is boosting local production and global partnerships.

Europe is capitalizing on advanced manufacturing and sustainability.

• Germany (9.0% CAGR) sees strong demand from EV component manufacturing, industrial coatings, and high-end packaging.

• UK (7.4% CAGR) focuses on sustainable inks, coatings, and specialty polymers, aligning with circular economy principles.

North America remains a strategic innovation hub.

• USA (6.6% CAGR) benefits from growing data center infrastructure and renewable energy systems, creating demand for conductive cable insulation compounds and high-dispersion grades for packaging and coatings.

Innovation and Customization as Growth Catalysts

Manufacturers are increasingly seeking customized grades tailored for specific performance needs—whether it’s enhanced conductivity for EV batteries, pigment stability for high-end packaging, or UV resistance for outdoor applications. The industry is witnessing a shift toward nanostructured solutions, which improve dispersion quality and conductivity in electronics and energy storage systems.

These advancements not only meet today’s product performance requirements but also enable compliance with stringent environmental regulations across regions. From low-VOC coatings to circular production models using recovered carbon black, sustainability is becoming integral to competitive strategy.

Application Expansion Unlocking New Revenue Streams

Specialty carbon black’s applications are rapidly diversifying:

• Lithium-ion batteries: High-purity grades optimized for energy storage are now critical in EV and renewable energy sectors.

• Conductive packaging: Electronics and sensitive goods require ESD protection, creating demand for carbon blacks with excellent stability.

• Masterbatches and engineered plastics: Growing in importance for precision-engineered components across industrial manufacturing.

Producers partnering with OEMs to co-develop grades for advanced coatings, inks, and polymers are securing long-term supply agreements, strengthening their competitive positions.

Addressing Market Challenges

While growth prospects remain strong, the market faces headwinds from volatile raw material prices and regulatory complexity. Feedstock fluctuations can disrupt production planning, while compliance with environmental and pigment standards can extend product approval timelines.

Manufacturers are responding with strategies such as cost optimization, vertical integration, and process innovation to mitigate risks. Adoption of cleaner manufacturing technologies—such as furnace optimization and carbon recovery systems—is also helping producers maintain profitability while meeting regulatory demands.

Competitive Landscape

The market is moderately consolidated, with Orion Engineered Carbons GmbH recognized as a leader for its broad product portfolio and advanced production capabilities. Other key players—Atlas Organics Private Limited, Black Bear Carbon B.V., Continental Carbon Company, Denka Company Limited, and Phillips Carbon Black Limited—are focusing on innovations in particle size control, surface treatment, and functionalization to meet evolving industry standards.

Strategic investments are reinforcing market capacity. In January 2024, Birla Carbon announced a Greenfield expansion adding over 240,000 tonnes of specialty carbon black capacity in India and Thailand, aimed at meeting rising demand in high-performance plastics, coatings, and conductive fillers across the Asia-Pacific market.

Request Specialty Carbon Black Market Draft Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-22877

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Outlook: A Decade of Strong, Solution-Driven Growth

From automotive lightweighting to high-efficiency energy storage, specialty carbon black is a critical enabler of innovation in manufacturing. The next decade will see its role expand as industries demand precision-engineered, sustainable, and high-performance materials.

For manufacturers, aligning with suppliers capable of delivering customized, application-specific grades will be key to maintaining competitiveness. With robust growth across Asia-Pacific, innovation leadership in Europe, and steady adoption in North America, the specialty carbon black market presents an opportunity for proactive players to strengthen their market position, optimize performance, and drive sustainable growth.

Related Insights from Future Market Insights (FMI)

Specialty Amino Acids Market – https://www.futuremarketinsights.com/reports/specialty-amino-acids-market

Carbon Black Market – https://www.futuremarketinsights.com/reports/carbon-black-market

Carbon And Graphite Felt Market – https://www.futuremarketinsights.com/reports/carbon-and-graphite-felt-market

Carbon Disulfide Market – https://www.futuremarketinsights.com/reports/carbon-disulfide-market

Editor’s Note:

The specialty carbon black market is witnessing robust growth, fueled by rising demand in coatings, plastics, and battery applications. Innovations in production and sustainability are driving competitiveness and market expansion. This report explores emerging trends, key players, and strategic opportunities shaping the industry’s future.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()