UK’s oil & gas ESP market to grow at 7.6% CAGR from 2025 to 2035, driven by North Sea brownfield optimization and delayed decommissioning strategies.

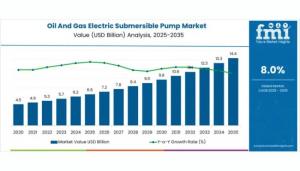

NEWARK, DE, UNITED STATES, August 6, 2025 /EINPresswire.com/ — The global Oil and Gas Electric Submersible Pump (ESP) Market is gearing up for a transformation, with its value projected to rise from USD 6.6 billion in 2025 to an impressive USD 14.4 billion by 2035, at a compound annual growth rate (CAGR) of 8.0%. For manufacturers, OEMs, and oilfield service providers, this surge signals more than just market expansion—it’s a call to meet the increasingly sophisticated demands of oil recovery under complex, high-pressure, and high-temperature environments.

At the core of this growth lies a definitive industry pivot: greater reliance on electric submersible pumps to maximize output, lower cost-per-barrel, and extend well life—especially across mature fields and unconventional reserves.

Meeting the Pressing Needs of Onshore Oilfields

Onshore operations, which are expected to account for 59.3% of the market revenue by 2025, are proving fertile ground for ESP adoption. With simpler logistics and lower development costs, these sites are accelerating enhanced recovery programs, aided by the precise pressure-handling capabilities of ESPs.

As wells mature and production becomes more volatile, multistage ESPs have emerged as the go-to solution. Multistage configurations, forecasted to dominate with 67.8% market share by 2025, offer unmatched flexibility across well depths and fluid properties. Their multiple impeller design enhances lift efficiency, extends operating life, and reduces downtime—an irresistible value proposition for operators focused on reducing intervention frequency.

Technological Momentum: The ESP as a Digital Workhorse

The performance bar for ESPs is being raised by digital innovation. AI-integrated monitoring, predictive maintenance analytics, and variable speed drive (VSD) controls are rapidly becoming standard features.

Industry leaders like Schlumberger, Weatherford, and Baker Hughes are rolling out advanced systems that offer real-time control, remote condition monitoring, and substantial CO₂ reductions. Notably, Schlumberger’s 2024 launch of the Reda Agile compact ESP and PowerEdge ESPCP systems signals a strong shift toward wide-operating range, rodless, and environmentally conscious pumping solutions.

Applications in Action: Global Field Case Scenarios

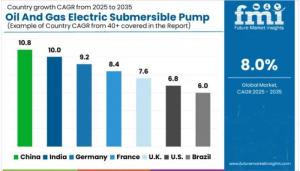

In the U.S., the ESP market is set to grow at a steady 6.8% CAGR, fueled by digital upgrades in the Permian and Bakken basins. High water cut wells are now equipped with multi-stage ESPs featuring fiber optic monitoring and automated shutoffs, minimizing downtime and operational risk.

In China, the market leads globally with a projected 10.8% CAGR, supported by national mandates to enhance oil recovery. New deployments in Xinjiang and Daqing fields rely on high-temperature, high-pressure systems, while domestic players ramp up VSD-integrated pump production.

India, registering a 10.0% CAGR, is turning to ESPs to minimize import dependency. Enhanced oil recovery (EOR) projects and localized manufacturing partnerships are advancing rapid adoption, particularly in Rajasthan and Assam.

Germany and the UK are adopting ESPs in brownfield developments and late-life offshore assets. With Germany growing at 9.2%, retrofits in aging reservoirs and geothermal co-production projects are fueling demand. Meanwhile, the UK’s 7.6% CAGR is backed by North Sea redevelopment and carbon intensity benchmarks set by the North Sea Transition Deal.

Responding to Critical Operational Demands

Operators are not just seeking pumps—they’re demanding performance under pressure. In 2025 alone, demand for ESPs rated over 1,000 bbl/day jumped by 21% as producers in Texas, the North Sea, and West Siberia raced to extend field life. Thermal-rated ESPs, capable of handling 300°F+ temperatures, are being deployed in SAGD (steam-assisted gravity drainage) wells in Saudi Arabia and Brazil.

Moreover, predictive failure analytics and remote surveillance have cut unplanned pullouts by 17%, significantly boosting uptime in gas-oil ratio (GOR) challenged zones.

Unconventional Applications on the Rise

ESP sales for unconventional and horizontal wells jumped 28% year-over-year in 2025. U.S. and Canadian operators in shale-rich areas like Permian and Montney adopted compact ESPs with gas-handling stages to outperform traditional rod pumps in high-sand, high-gas environments.

In Argentina’s Vaca Muerta, advanced ESPs with dual-frequency VSDs stabilized early flowbacks and reduced motor trips by 31%, while new abrasion-resistant coatings added 22% to pump lifespan in horizontal wells.

A Competitive Landscape Fueled by Innovation

The market’s leading players are not resting on legacy performance. Schlumberger, with a 21.5% share, is pushing boundaries in both unconventional and conventional wells. Weatherford and Baker Hughes are infusing AI into their systems for better diagnostics. Flowserve and Sulzer are winning ground in the Middle East, where sand-laden, high-temperature wells require ruggedized pump designs.

Emerging competitors like Novomet and Halliburton are focusing on corrosion-resistant and compact configurations, while manufacturers like WILO, EBARA, and Grundfos expand applications for shale and water-injection scenarios.

Request Oil And Gas Electric Submersible Pump Market Draft Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-22776

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Outlook for Manufacturers and EPC Contractors

For manufacturers, the road ahead is paved with demand for intelligent, efficient, and resilient pumping solutions. Field operators are looking beyond just lift—they want insight, automation, and minimal disruption. EPC contractors sourcing pump systems now prioritize:

• Subsea integration readiness

• CO₂-reduction capabilities

• Modular installation and serviceability

• Real-time diagnostics and remote reconfiguration

As mature fields become digital oilfields, and as exploration dives deeper and further, manufacturers equipped with next-gen ESP portfolios will define the next decade of oil recovery.

Related Insights from Future Market Insights (FMI)

Oilfield Surfactants Market – https://www.futuremarketinsights.com/reports/oilfield-surfactants-market

Oil Breather Tank Market – https://www.futuremarketinsights.com/reports/oil-breather-tank-market

Oil Field Drill Bits Market – https://www.futuremarketinsights.com/reports/oil-field-drill-bits-market

Oilwell Completion Tools Market – https://www.futuremarketinsights.com/reports/oilwell-completion-tools-market

Editor’s Note:

The Oil and Gas Electric Submersible Pump Market is undergoing transformative growth driven by offshore redevelopment and enhanced recovery efforts. As global energy dynamics evolve, ESP technology stands at the forefront of efficiency and reliability. This market insight explores future opportunities for stakeholders in a rapidly advancing upstream landscape.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()