Bill Splitting Apps Market: Growing globally with diverse users, AI innovation, corporate demand, and regional trends.

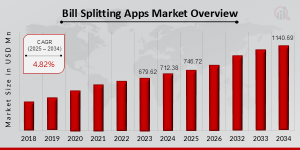

TEXAS, NY, UNITED STATES, August 6, 2025 /EINPresswire.com/ — Bill Splitting Apps Market have rapidly become essential financial tools for millions of people worldwide. They transform the way groups manage shared expenses—from restaurant outings among friends to rent and utility bills between roommates, and even costs among colleagues for business lunches or team events. As global digitalization increases, the market for these apps is experiencing significant growth, prompted by evolving user needs, new technologies, and changes in social and financial behaviors.

Market Segmentation:

Diverse Demographics and Learning Models

Bill splitting apps serve a wide spectrum of users, primarily divided into two categories: Private Users and Commercial Users.

Private Users friends, families, roommates, and travelers make up over 75% of the user base. They use apps like Splitwise, Tricount, or Billr to streamline day-to-day shared expenses such as dining, groceries, trips, or household costs. The highest adoption is among tech-savvy young adults—from Gen Z to millennials—who are comfortable with digital tools and prefer instant, cashless transactions for transparency and convenience. For these users, apps automate calculation, reduce disputes, and provide instant payment reconciliation.

Download Sample Report- https://www.marketresearchfuture.com/sample_request/22401

Commercial Users (about 19% of the market) include businesses, co-working spaces, startups, event managers, and freelancers. They leverage these platforms for expense management in group projects, office utilities, team lunches, or shared subscriptions. Features like group transaction reports, invoice generation, and exportable CSVs make these apps attractive to the growing gig economy, distributed teams, and modern corporate environments.

The segmentation continues by platform preference, with Android taking the global lead (almost 70% market share), catering to diverse geographies and economic backgrounds due to its affordability. iOS remains strong in high-income markets. Demographics show especially high regular use (at least weekly) among users aged 18–34, creating 2–3 expense groups and dozens of monthly transactions.

Market Drivers: Technology, Accessibility, and Globalization

Three major pillars drive the explosive growth of the bill splitting apps market:

1. Technology

Rapid advances in mobile technology and the rise of smartphones are central. The accessibility of cheap, data-enabled devices puts powerful apps in the pockets of nearly everyone. Integration with payment systems (credit cards, mobile wallets, digital banks) and features such as group notifications, digital receipts, and push reminders have made the process seamless for users. Many apps also integrate with social media for enhanced engagement.

2. Accessibility

As people become more comfortable managing their finances digitally, or rely more on group activities, the demand for such apps surges. Contactless payment adoption post-pandemic, the rise in remote work, and the explosion in social group activities (after COVID-19 restrictions eased) have all accelerated usage. The ability to pay and settle instantly—anywhere, anytime—drives retention and opens the door for new user segments.

3. Globalization

Modern society is more mobile and collaborative than ever before. The increase in group travel, international study, urban shared living, and distributed workplaces has created strong demand for solutions supporting multi-currency, cross-border payments, and different languages. Bill splitting apps that offer region-specific language and localized payment options are attracting users in emerging markets, especially in fast-growing regions like Asia Pacific and Latin America.

Browse a Full Report (Including Full TOC, List of Tables & Figures, Chart) –

https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22401

Market Opportunities: AI Integration, Niche Languages, and Corporate Demand

As the market matures, several exciting opportunities are emerging:

AI Integration: Artificial intelligence and machine learning are ushering in smarter features, such as automated expense categorization, predictive analytics, fraud detection, and personalized recommendations. AI can spot patterns in spending, streamline group settlements, and even suggest optimal ways to split costs based on individual preferences or historical behavior.

Niche Languages and Localization: Developers can expand adoption by offering niche languages and hyper-local payment system integration. By supporting numerous currencies, languages, and country-specific transaction styles, apps can gain an edge in underpenetrated markets. For instance, Asia-Pacific’s need for multi-language and payment gateway diversity has seen a surge in adoption and is expected to remain the fastest-growing region through 2033.

Corporate Demand: As remote and gig work expand, companies are turning to bill splitting apps to efficiently manage shared business expenses, employee reimbursements, and team outing costs. Customized reporting, corporate dashboards, export functions, and compliance checks are increasingly in demand from business and institutional clients.

Fintech Partnerships: Collaborations with fintechs, banks, and digital wallets unlock enhanced features like instant payout, credit integration, and crypto support, as well as boosting security and consumer trust.

Restraints and Challenges: Retention Rates and Quality Control

No market is without its hurdles, and bill splitting apps face distinct challenges:

User Retention:

With so many competing apps offering similar features, keeping users long-term is a challenge. Subscription fees, ads, or lack of fresh features may prompt users to switch or drop off. Continuous innovation, loyalty rewards, and more engaging user interfaces are critical to maintain engagement.

Quality and Security:

Security of personal and financial data is pivotal. Privacy concerns and the risk of hacking or data breaches—especially with sensitive bank details involved—put pressure on app providers. Compliance with new privacy rules like GDPR in Europe or CCPA in California increases costs. Companies must also combat fraud and abuse, ensure error-free payment reconciliation, and manage bugs and technical glitches that could harm reputation.

Market Fragmentation:

With so many competitors, feature parity is high. To stand out, players must deliver excellent customer support, local content, broader integration (social media, financial services), and seamless cross-platform performance.

Regulatory Complexity: Varying financial regulations across countries (e.g., KYC requirements, anti-money laundering laws, payment licensing) complicate international rollouts and require continuous legal adaptation.

Regional Analysis: Global Growth with Regional Nuances

Asia Pacific

APAC leads with over 41% of the global market, thanks to rapid smartphone growth, aggressive digital payment adoption, and a vast young population. Countries like India and China are hotspots for app launches and innovation, with government drives for ‘cashless economies’ bolstering the market. Local languages, multi-currency functions, and integration with popular regional payment methods set successful apps apart. APAC will likely see the fastest CAGR (over 20%) into 2033.

North America

North America, especially the United States, boasts over 41 million active monthly users and high frequency, driven by college students and young professionals in cities with robust peer-to-peer financial ecosystems. Integration with payment networks and banking APIs makes apps particularly sticky. High consumer expectations for convenience, speed, and security, as well as the popularity of dining out and split living, fuel the market.

Europe

Europe’s cultural and legal landscape creates a mixture of traditional and modern approaches. Urbanized regions and cities with shared living arrangements drive adoption, while stringent privacy and payment regulations challenge expansion. Niche markets exist in shared services, co-living, and urban mobility.

Latin America, Middle East and Africa

Emerging markets in these regions present a massive untapped user base, as smartphone use and digital banking rise. Language diversity, economic constraints, and regional payment methods require tailored solutions. Providers who localize can capture these rapidly growing segments.

Market Key Players: Innovators and Industry Leaders

A mix of established fin techs and digital-first startups shape the competitive landscape:

Split wise: Renowned for user-friendly group expense tracking, multi-currency support, and robust integration with payment platforms; highly valued by travelers and roommates.

Venmo: A PayPal company blending social features with peer-to-peer bill splitting, beloved by U.S. millennials and Gen Z for its simplicity and connected payment options.

PayPal: Leading the crossover between classic digital payment and bill splitting, PayPal’s new features make it a one-stop platform for managing group costs, especially for international transfers.

Tricount, Splid, Tab: Popular for their flexibility, multi-language/currency features, and receipt scanning for complex group scenarios.

Cash App, Zelle, Google Pay, Facebook Pay, Billr, Settle Up, Round Up, Divvy, Owe Money, Payit, Splt: Each brings unique offerings, from deep platform integrations to business-ready solutions for handling corporate expense management and reporting.

Major recent developments include new smart features (like AI-powered auto-suggestions), expanded partnerships , and launch of contactless integration options for European and APAC users.

Top Trending Reports:

Online Simulation Games Market

https://www.marketresearchfuture.com/reports/online-simulation-games-market-22276

Submarine Optical Fiber Cable Market

https://www.marketresearchfuture.com/reports/submarine-optical-fiber-cable-market-22287

E Beam Wafer Inspection System Market

https://www.marketresearchfuture.com/reports/e-beam-wafer-inspection-system-market-22387

Mini Led Market

https://www.marketresearchfuture.com/reports/mini-led-market-22524

Online Airline Booking Platform Market

https://www.marketresearchfuture.com/reports/online-airline-booking-platform-market-22517

Massive Multiplayer Online MMO Games Market

https://www.marketresearchfuture.com/reports/massive-multiplayer-online-mmo-games-market-22498

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Sagar Kadam

Market Research Future

+ +1 628-258-0071

email us here

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()